Geotimes

Untitled Document

Feature

Investigating Mining

Frauds

David M. Abbott Jr.

I was a geologist for the U.S. Securities and Exchange Commission (SEC) for

21 years. My combination of profession and employer prompted many people to

ask, "You're a what for whom?" This is a natural enough question concerning

an agency known for its lawyers and accountants, not for its geologists and

engineers. The answer was simple: "mines and oil and gas wells."

My

duties fell into two major categories: assisting mining and oil and gas firms

that were trying to comply with full disclosure provisions of the securities

laws, and investigating and helping in the prosecution of those defrauding their

investors. The latter category is the area of forensic geology — using

earth science to investigate crimes, particularly cases brought to court. Investigation

and presentation of technical evidence and opinions regarding mining fraud cases

is a major area of forensic geology.

My

duties fell into two major categories: assisting mining and oil and gas firms

that were trying to comply with full disclosure provisions of the securities

laws, and investigating and helping in the prosecution of those defrauding their

investors. The latter category is the area of forensic geology — using

earth science to investigate crimes, particularly cases brought to court. Investigation

and presentation of technical evidence and opinions regarding mining fraud cases

is a major area of forensic geology.

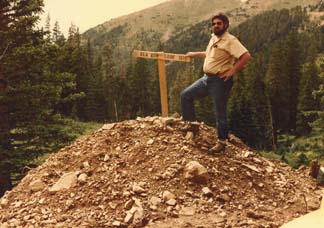

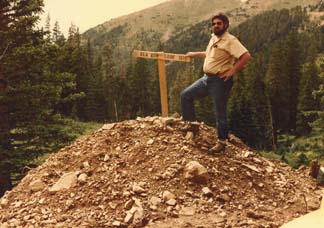

These piles of tailings from an abandoned

mine in Swandyke, Colo., were salted with fool’s gold to trick investors

into thinking the pile had valuable ore. Each pile has a wooden “T”

sign with a serial number so that an investor could identify an individual pile.

All photos courtesy of David M. Abbott Jr.

Mining fraud has probably been around in one form or another for centuries.

Georgius Agricola, in his 1556 De Re Metallica, the first book on everything

related to mining, noted that "a prudent owner, before he buys shares,

ought to go to the mine and carefully examine the nature of the vein, for it

is very important that he should be on his guard lest fraudulent sellers of

shares should deceive him."

What is a fraud? The simplest definition I know is that fraud is "theft

by lying," the claiming of that which is not so. One of the most infamous

definitions of a mine is "a hole in the ground owned by a liar" (a

quote that was attributed to Mark Twain in The Autobiography of John Hays

Hammond but which appears nowhere in Twain's works and has not be proven

authentic).

In my years at SEC, I had the opportunity to investigate several cases involving

classic fraud, gathering key evidence, even though I usually was not able to

present it in court. Following are just a few of my favorites.

Digging up dirt

A number

of the cases I investigated are known as "dirt pile" cases. In order

to avoid the statutory definition of a security, which includes the phrase,

"undivided interest in oil and gas or other mineral right," investors

buy a specific very small volume (a few tons or cubic yards) of ground or a

specified pile of "ore" that is guaranteed to contain a specified

amount of gold and other precious metals. If the pile or volume does not contain

the minimum guaranteed amount, enough additional material is added to an investor's

pile to make up the difference.

A number

of the cases I investigated are known as "dirt pile" cases. In order

to avoid the statutory definition of a security, which includes the phrase,

"undivided interest in oil and gas or other mineral right," investors

buy a specific very small volume (a few tons or cubic yards) of ground or a

specified pile of "ore" that is guaranteed to contain a specified

amount of gold and other precious metals. If the pile or volume does not contain

the minimum guaranteed amount, enough additional material is added to an investor's

pile to make up the difference.

Robert Fusfeld, an attorney for the Securities

and Exchange Commission, stands atop an investor’s pile of “ore”

on the road to Swandyke, Colo. This particular pile was composed of dirt from

the road and was so barren that the promoters had thrown a couple of fool’s

gold-bearing rocks from nearby mine dumps on the pile.

Because the investor "owns" his dirt pile, he could come to the site

and mine and process it, or he can hire a supposedly independent contractor

to do the mining and processing to recover the precious metals. Investors invariably

take the latter option.

Typically, each dirt pile has a wooden sign with a serial number so that an

investor can identify his or her individual pile. In the case of an abandoned

mine in Swandyke, Colo., the piles were composed of the tailings — rock

deemed useless by the miners. Because the tailings did not actually contain

valuable minerals in quantities large enough to be economic, the promoters in

this particular case salted the surface of the piles with fool's gold, or pyrite-rich,

samples. Another company promoting such ventures produced a marketing video

tape showing how these investments worked. The video was titled How to Turn

Dirt into Gold.

Unfortunately, in this case and most of the other cases where I had excellent

evidence of fraud, defense attorneys used various means to keep me from testifying,

frequently by settling the case by consent without admitting or denying the

allegations made in SEC's complaint.

A dirt pile case in which I was able to testify involved properties in French

Guiana. Those who have seen the movie Papillon will recall that French

Guiana was a French penal colony until shortly after World War II. One of the

tasks the prisoners performed was the digging of prospect holes in the gold

placers (alluvial deposits) that occur in the central part of the country.

To reach the site of this scam, my colleagues and I left from the town of Saint-Laurent

du Maroni, on the Maroni River, the border between French Guiana and Suriname.

Saint-Laurent was also the site of one of the major French prisons, which was

cleaned up and used for part of the movie. The placer fields were about 180

kilometers south along a road bulldozed through the jungle.

Although the properties contained gold, it was indeed a fraud: The investors

were not informed that only French citizens could own the gold. American companies

could be contracted to mine the gold, but American investors could not receive

the gold promised in an investment brochure.

The final twist in the case came during the criminal trial of the chief promoter

of the scam. He called me to testify in his defense, but I did not end up helping

his case. The promoter, who was defending himself, asked me if mining was occurring

during my visit to the site, and I acknowledged that it was. However, I also

testified that there was no attempt being made to mark or otherwise segregate

the ore "owned" by one investor from another, and that American investors

had no right to receive any gold. The promoter was convicted.

Murder and a magnetometer

One day I received a phone call from an investigator for one of Colorado's district

attorneys. I had met him while working on the Swandyke, Colo., dirt pile case.

After exchanging brief introductory pleasantries, the investigator asked me

if I knew anything about a "magnometer," and about half a dozen other

mispronunciations of "magnetometer." Once I determined that a magnetometer

was what he wanted to know about, I asked why he was interested in one.

Two men and their pickup truck were missing from a nearby former mining town,

he told me, and the police had received a tip that the men had been killed and

their bodies and truck had been buried in a mine dump. The investigator wanted

to know if I knew where he could rent a magnetometer to find the truck in the

mine dump — a perfectly reasonable, albeit unconventional, use for a magnetometer.

I suggested that the investigator take the two- to three-block walk from his

office up to the geophysics department at the Colorado School of Mines and announce,

"Have I got a lab exercise for you." It would make for a wonderful

student project, I told him — a small area and a discrete target located

not too far from campus. The geophysics students could look for the truck using

a variety of geophysical methods.

The investigator followed my advice, and the geophysics department concurred

that looking for a buried truck in a mine dump provided an excellent student

exercise. The students, however, did not find a truck with bodies in it, because

the truck was down a different mine shaft: The police did not have the correct

information. It was not until two or three years later that a prison inmate

told authorities that the men and the truck had been dumped down a mine shaft,

not buried in the mine dump. Authorities found the truck and bodies, and the

murder investigation proceeded.

Secret techniques

A large

number of cases I investigated, including many of the dirt pile cases, involved

secret processes that purportedly can detect gold, silver, platinum, palladium

and other precious metals that are undetectable by fire assay, the standard

method of making determinations of the quantity of these metals in geologic

materials. The stated reason for the secrecy of the process is that the large

mining companies will steal the process from its discoverer without providing

adequate compensation for the development of the process.

A large

number of cases I investigated, including many of the dirt pile cases, involved

secret processes that purportedly can detect gold, silver, platinum, palladium

and other precious metals that are undetectable by fire assay, the standard

method of making determinations of the quantity of these metals in geologic

materials. The stated reason for the secrecy of the process is that the large

mining companies will steal the process from its discoverer without providing

adequate compensation for the development of the process.

A promoter of a “secret process”

for creating precious metals claimed that this bar contains more than $35,000

worth of gold, silver and platinum-group metals. Later analysis showed it was

composed of common lead.

Americans have an innate love for rooting for the little guy, the underdog,

particularly when the little guy is engaged in fighting big corporations or

the government. Furthermore, there is the excitement of becoming involved in

something that only a relatively few, select others know about, particularly

when coupled with promises that significant profits can be made in a short period

of time. The air of conspiracy is appealing. Adding to the appeal are assertions

by the promoters of such ventures that a significant portion, if not all, of

the sums invested can be written off as a tax deduction.

Many of these "secret" process schemes are supported by a notorious

group of assayers who seem to be able to detect large quantities of precious

metals in samples that cannot be found by reputable analytical firms. These

assayers support themselves as independent labs doing analyses for a variety

of people who like their results. Because these assayers have no connection

with or knowledge of the schemes, they cannot be legally charged with participation

in the frauds.

These assayers use secret techniques they have developed to correct the analytical

values reported by AA machines, the traditional machine used for analysis. Someone

once told me that one of these assayers testified in a deposition that he used

a secret formula for making the corrections, a formula he had memorized so that

no spies could learn it by breaking into his lab. When he analyzed a sample,

he would mentally calculate the "correct" value reported by his AA

machine using this secret formula and write the "corrected" value

down on his analytical report sheet.

Some of the techniques used by these assayers were investigated by respected

experts in the analysis of platinum-group metals. Eric L. Hoffman and Bernie

Dunn, in a paper in the Canadian Institute of Mining, Metallurgy, and Petroleum's

Special Volume 54 in 2002, reported that if a person failed to remove

iron from the sample prior to analysis, erroneous readings of platinum-group

metals could be obtained. In a demonstration using these invalid and improper

techniques, Hoffman and Dunn analyzed a U.S. nickel coin and reported that the

coin contained 11.5 troy ounces of platinum, 5.63 troy ounces of palladium,

and 5,314 troy ounces of iridium on a per ton basis. (Nickels actually are made

mostly of copper, with some nickel.)

My ultimate rabbit-out-of-the-hat

trick

One Friday afternoon preceding a Memorial Day weekend, I received a call from

SEC's Salt Lake City office asking if I could testify in court the following

Thursday. The case involved a defendant who claimed he had driven his tractor

up a road five years previously to perform improvements and assessments on his

mining property.

It was late enough in the afternoon that I could not do much before offices

closed. On Tuesday, however, I located an air photo firm that flew the area

regularly for the nearby Bingham Canyon copper mine and obtained photos of the

area that I was interested in. I flew over to Salt Lake City, identified the

area in “before” and “after” air photos covering the road

that the tractor had purportedly "improved," and ordered copies.

On Wednesday, I did a field check. The bottom of the road had been washed out

sufficiently that a tractor could not have driven across the washout, a feature

visible in the before and after air photos. I also photographed a colleague

standing in the midst of a grove of alder trees that had grown up on the "improved"

road. I then cut down one of the trees and collected a piece of the trunk so

that I could reinforce my testimony with the count of more than 25 tree rings.

The presence of such old trees showed that the defendant had not done the claimed

assessment and improvement work on his mining property five years previously.

This case was one where I had excellent evidence — but again, I never made

it to the stand.

Abbott

is a consulting geologist in Denver, Colo., specializing in evaluating natural

resources, disclosures about them, reserve estimates, and geoscience ethics and

practices.

Back to top

My

duties fell into two major categories: assisting mining and oil and gas firms

that were trying to comply with full disclosure provisions of the securities

laws, and investigating and helping in the prosecution of those defrauding their

investors. The latter category is the area of forensic geology — using

earth science to investigate crimes, particularly cases brought to court. Investigation

and presentation of technical evidence and opinions regarding mining fraud cases

is a major area of forensic geology.

My

duties fell into two major categories: assisting mining and oil and gas firms

that were trying to comply with full disclosure provisions of the securities

laws, and investigating and helping in the prosecution of those defrauding their

investors. The latter category is the area of forensic geology — using

earth science to investigate crimes, particularly cases brought to court. Investigation

and presentation of technical evidence and opinions regarding mining fraud cases

is a major area of forensic geology.

A number

of the cases I investigated are known as "dirt pile" cases. In order

to avoid the statutory definition of a security, which includes the phrase,

"undivided interest in oil and gas or other mineral right," investors

buy a specific very small volume (a few tons or cubic yards) of ground or a

specified pile of "ore" that is guaranteed to contain a specified

amount of gold and other precious metals. If the pile or volume does not contain

the minimum guaranteed amount, enough additional material is added to an investor's

pile to make up the difference.

A number

of the cases I investigated are known as "dirt pile" cases. In order

to avoid the statutory definition of a security, which includes the phrase,

"undivided interest in oil and gas or other mineral right," investors

buy a specific very small volume (a few tons or cubic yards) of ground or a

specified pile of "ore" that is guaranteed to contain a specified

amount of gold and other precious metals. If the pile or volume does not contain

the minimum guaranteed amount, enough additional material is added to an investor's

pile to make up the difference.  A large

number of cases I investigated, including many of the dirt pile cases, involved

secret processes that purportedly can detect gold, silver, platinum, palladium

and other precious metals that are undetectable by fire assay, the standard

method of making determinations of the quantity of these metals in geologic

materials. The stated reason for the secrecy of the process is that the large

mining companies will steal the process from its discoverer without providing

adequate compensation for the development of the process.

A large

number of cases I investigated, including many of the dirt pile cases, involved

secret processes that purportedly can detect gold, silver, platinum, palladium

and other precious metals that are undetectable by fire assay, the standard

method of making determinations of the quantity of these metals in geologic

materials. The stated reason for the secrecy of the process is that the large

mining companies will steal the process from its discoverer without providing

adequate compensation for the development of the process.