Oil Patch

Employment of and support for paleontologists in the industry is on the decline. But the discipline remains a key component for oil exploration.

By Martin

B. Farley and John M. Armentrout

| Home | Calendar | Classifieds | Subscribe | Advertise |

| Geotimes

Published by the American Geological Institute |

Newsmagazine

of the Earth Sciences

October 2000 |

| Fossils

in the

Oil Patch Employment of and support for paleontologists in the industry is on the decline. But the discipline remains a key component for oil exploration. By Martin

B. Farley and John M. Armentrout

|

|

Paleontologic staffs at U.S.-based major oil companies have decreased by 90 percent since 1985 and are below critical mass in all but three companies. Critical mass would have at least one paleontologist in each of the major fossil groups — foraminifera, palynology and calcareous nannofossils. At the same time, our analysis of data for oil companies in the Houston area showed that companies employing in-house paleontologists had replacement costs averaging more than $1 per barrel lower in the last two years than companies without in-house paleontologists (taken from data published in the Houston Chronicle May 23, 1999, and May 21, 2000). This difference most likely reflects the advantage of applying technology correctly, which includes methods other than paleontology, but paleontology is a key part of this savings.

The optimal application of paleontology in oil exploration will require improved university education of the paleontologic concepts useful in stratigraphy. It is particularly important to educate those geoscientists who will not become paleontology specialists, as some will become decision makers who will be more likely to include paleontology in studies if they appreciate its utility. At the same time, oil companies must recognize that paleontologic expertise cannot be conjured up on demand but must be maintained as a core resource if it is to be available at all. Sustained efforts addressing both concerns are essential to sustaining high-quality industrial paleontology.

Paleontology for exploration

Paleontology continues to play a valuable role in petroleum industry exploration and production. Even as technological changes sweep the industry, integrating paleontologic data with these new technologies, such as 3-D seismic, has become a standard practice.

Along with seismic reflection profiles and well logs, paleontology is a key tool in correlation. It is the most useful tool for constructing age models necessary for all time-dependent modeling, such as thermal maturation of potential hydrocarbon source rocks. And paleontology helps characterize depositional environments for predicting the distribution and quality of reservoir, seal and source rocks.

Paleontologists must be part of any exploration team. Testing multiple hypotheses using all data, including paleontologic data, results in a significantly better geologic model and prevents “transom paleontology,” in which samples are sent to the paleontologists who must then generate reports without critical discussion and consideration of alternative interpretations. This isolation of critical thinking is particularly acute when geologists and geophysicists using the data are geographically isolated from paleontologic consultants.

Biostratigraphy, the study of the distribution of fossils in the stratigraphic record, is a valuable and inexpensive correlation tool, even in today’s era of 3-D seismic and advanced suites of well logs. The 1999 cost of the biostratigraphy group at Exxon, for example, was about equal to 10 days of drilling on an ultra-deepwater prospect.

All correlation tools are indirect measures of subsurface geology, so

that no one alone offers an unambiguous interpretation. The quality of

stratigraphic correlation is improved by using as many tools as possible.

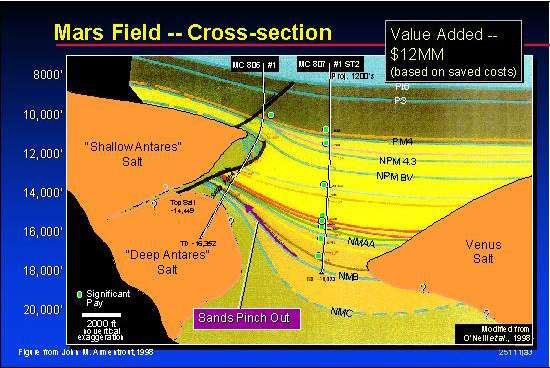

The Mars field in the Gulf of Mexico is a good example. Mapping structural

closure using seismic data suggested additional hydrocarbon potential beneath

a salt overhang. Drilling into that section failed to find the reservoir

at the predicted depth.

| However, detailed biostratigraphy demonstrated that the drilled section was younger than the predicted reservoir interval, and the decision was made to drill deeper. The predicted reservoir was found, contained hydrocarbons and added significantly to the total value of the field. Without the integration of the biostratigraphic interpretation with the seismic mapping, the additional hydrocarbon reserves would have been missed. |

The Mars Field, Shell’s deep-water Gulf of Mexico property with more than 500 million recoverable oil-equivalent barrels, is an example of how high-resolution biostratigraphy is critical to field development. Biostratigraphic correlations of Mississippi Canyon 806 #1 demonstrated a repeated section of stratigraphy. Seeing this, the team could create a model that allowed a precise calculation of recoverable reserves and the design of an enhanced development plan for oil recovery, reducing costs by $12 million. Courtesy of Martin Farley. |

Biostratigraphy is the primary method for determining the ages of geologic events. These ages are the parameters for rate-dependent modeling that reconstructs burial history or forecasts thermal maturity. Global correlation charts allow consistent expression of events on a single stratigraphic framework. As a result, local depositional events that are biostratigraphically calibrated can be accurately correlated to numerical ages in a mathematical model of basin history.

Predicting reservoir, seal and source rock distribution and quality using seismic reflection profiles requires detailed information on depositional systems, some of which can be provided by paleontologists. Modeling sands deposited in a coastal plain fluvial system is different from modeling a deep marine gravity-flow system. Analyzing paleowater depth using fossil biofacies assemblages can help differentiate these depositional systems and even more subtle differences. Paleontologic data on paleoclimate provide constraints on conditions affecting paleoproductivity, source rock deposition, and probable diagenetic histories that affect reservoir quality and consequent fluid-flow patterns. Analyzing organic matter in potential source rocks allows prediction of oil vs. gas potential, critical to an economic assessment of exploration opportunities.

Teaching and sustaining integration

Undergraduate education is the key to reviving an appreciation for the value of paleontology. It is our experience that many geologists and geophysicists entering the oil industry, even those with graduate work involving sequence stratigraphy, do not have the background to appreciate the utility of paleontological data. Undergraduates exposed to the usefulness of paleontologic data for solving geologic problems will expect to use such data during their careers, no matter their career tracks. Paleontologic data facilitates constructing age models, measuring rates of geologic processes, differentiating local geologic events from global geologic events based on precise correlation, and reconstructing evolutionary and environmental change. Students must learn an integrated approach to solving geologic problems.

Graduate training is more specialized, but even a graduate student should be encouraged to integrate data from other disciplines into a thesis. Paleontology can play a significant role in this training, as a test of correlations of isotopic values or seismic reflection geometry, for determining paleobathymetry of depositional systems, and for constraining the effect of tectonism on local paleoclimatology.

Industrial paleontologists generally specialize in single taxonomic

groups, such as foraminifera, nannoplankton or palynomorphs. Integrating

the data collected by each specialist will result in new questions about

an evolving interpretation. On a larger scale, these data should be integrated

with the geophysical, geological and geochemical data, and work on each

data set should feed back into the others. Each participant in the process

benefits from exposure to the other specialties, and exclusion of any specialty

limits the quality of integration, the rigor of the final interpretation,

and the potential for cross training.

Short courses can also teach this integrative approach. Hands-on exercises

should encourage the geoscientists and paleontologists to work together

and integrate several types of data, formulate working hypotheses, and

make the most probable interpretation. Lessons learned in the short course

should apply to on-the-job problem solving. Exposure to sound methods of

paleontology and data integration will be wasted if it cannot be applied

to current work.

Of course, an integrated approach is most successful when experienced senior scientists mentor younger, commonly more computer-savvy, technologists. The combination of experience and high-tech tools results in outstanding productivity and significantly better interpretations.

However, the small paleontologic staffs at oil companies now generally coordinate raw data generated by consultants. They have little or no time for original data generation and no time for research. Mentoring of new paleontologic staff members by highly experienced staff is almost extinct.

Many paleontologists no longer employed by oil companies have gone into consulting, often for a former employer. However, lack of work during lows in the volatile cycles of oil prices has forced many consultants to leave paleontology in search of more stable incomes. In addition, many consultants are ready to retire. Thus, demands for paleontologic data cannot always be met through hiring consultants. Furthermore, because consultants are paid by the samples interpreted, they have no time and little incentive for research or mentoring.

Using the data

The industry’s decreased support for paleontology extends beyond its employment practices. In addition to discontinuing its own research, the oil industry has greatly reduced its support of university and museum research.

Historically, companies funded research that benefited the paleontologic community as a whole. Take, for example, the micropaleontology consortium organized by William A. Berggren at the Woods Hole Oceanographic Institution, which began in 1970 and has provided the geologic community with state-of-the-art global time scales. The number of companies supporting the consortium was 14 in the early 1980s. By 1990 it was six, and now it’s down to two.

Oil company support has been critical for basic data cataloging in paleontology, supporting such efforts as the Ellis and Messina micropaleontology catalogs (forams, ostracodes, diatoms) compiled at the American Museum of Natural History. These databases have been valuable compendia available to the industrial, government and academic communities. Reduced support has meant the number of subscriptions to the foraminiferal catalog has declined from 21 to 13 over the past five years. The diatom catalog has been discontinued.

Paleontological approaches and techniques in academia and the oil industry

have diverged because of differences in available data and in what is viewed

as standard tools. Industry data sets mainly include extinction events

discovered in a large number of wells. They can analyze fossil occurrences

with graphical or probabilistic tools. This information is then inte-

grated with geological and geophysical data for a complete sequence

stratigraphic analysis to a much greater degree than is common in academic

studies.

Academic paleontologists commonly apply multivariate statistical tools to a census of fossil populations and include data such as stable isotopes. This method requires a greater investment in data acquisition that can then be dissected for useful patterns in much greater detail. Academic paleontologists have also taken the lead in attempts to apply statistical confidence limits to fossil ranges.

Industry and academia can learn from each other to make the most of existing data sets. Industrial paleontologists can use the same statistical tools academic paleontologists employ to extract new information from the basic data that have cost so much to acquire. An example is an industry-academic consortium, the Technical Alliance for Computational Stratigraphy, hosted by the Energy and Geoscience Institute of the University of Utah. The consortium has been building an interactive computer system to make the tools academic paleontologists have developed easily applicable in the petroleum industry. The system is designed to import the large data sets that the petroleum industry uses, and then rapidly analyze and plot the results to reveal patterns that are not obvious in the raw data. This approach could be a major step forward in making data analysis reproducible and automated.

Paleontology is a valuable tool in oil exploration when it is integrated with other geological or geophysical data sets, such as outcrops, seismic lines or well logs. Acquiring and integrating paleontologic data demands that all industry geoscientists understand paleontologic principles and that exploration teams include paleontologists. This integration is threatened by the limited understanding current university graduates have of paleontology, and oil companies’ indifference to the effort required to create and maintain paleontologic expertise. Preserving paleontology’s contribution to exploration success will require a renewed attention to paleontology and stratigraphy education, and a commitment within the oil industry to maintain paleontologic technologies.

Armentrout worked 25 years as an exploration geologist with Mobil Oil Co. until its merger last year with Exxon, applying biostratigraphy to basin analysis worldwide. He is now an affiliated professor of geology at the University of Washington and runs a consulting company, Cascade Stratigraphics in Portland, Ore.

|

Geotimes Home | AGI Home | Information Services | Geoscience Education | Public Policy | Programs | Publications | Careers |