Geotimes

Feature

Assessing Iraq’s

Oil Potential

Mohammad Al-Gailani

Sidebar:

War Numbers

Iraq is one of the most hydrocarbon-rich countries in the Middle East, and

in the future, it could become one of the primary oil producers in the world.

A thick sedimentary succession (from Cambrian to Recent), robust structures,

high individual well productivity and extensive oil reserves are some of the

main characteristics of Iraqi oil fields.

The latest

estimates put Iraq’s potential reserves at around 150 to 200 billion barrels

of oil and 106 trillion cubic feet of gas. These figures put Iraq in the forefront

of oil-producing countries: Iraqi oil reserves are considered to be the second

largest in the world, after Saudi Arabia’s.

The latest

estimates put Iraq’s potential reserves at around 150 to 200 billion barrels

of oil and 106 trillion cubic feet of gas. These figures put Iraq in the forefront

of oil-producing countries: Iraqi oil reserves are considered to be the second

largest in the world, after Saudi Arabia’s.

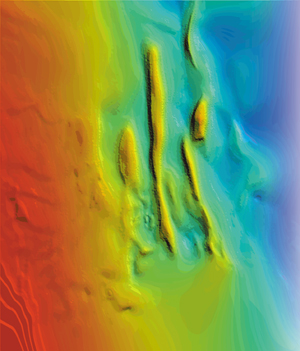

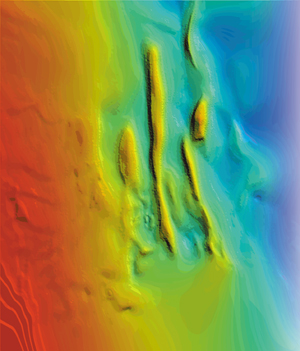

The super-giant fields of southeastern

Iraq are the largest concentration of super-giants to be found anywhere in the

world. Part of the upper Jurassic-aged Gotnia reflector, based on 1980s 2-D

seismic data, they are, from left to right and top to bottom, as follows: Ratawi;

Rachi; West Qurna; North and South Rumaila (measuring over 117 kilometers long);

Tuba; Zubair; Majnoon; and Nahr Umr Fields. All images courtesy of Mohammad

Al-Gailani.

Unfortunately, unlike neighbor Saudi Arabia, Iraq has been unable to deploy

the latest technology, such as 3-D seismic, to find its reserves. Present reserve

estimates of Iraq’s oil are based on 2-D seismic technology from the 1980s.

Still, the estimated success rate in Iraq ranges from one in two in the Mesopotamian

Basin to one in four in the western and northwestern stable platform, with the

overall success rate exceeding 72 percent — perhaps the highest success

rate achievable anywhere in the world. Oil exploration costs are among the cheapest

globally, with the current cost estimated at around 50 cents per barrel.

We now know that Iraq’s past governmental practices of nationalization

and central planning are incompatible with the fast-track approach now required

to meet future potential reserves requirements for the new millennium —

especially in the light of the huge national debt accumulated as a result of

three Gulf wars and prolonged sanctions. Work must start immediately to regain

the prewar production capacity of 3.5 million barrels of oil per day. Then Iraq

can slowly move up to its planned future production target of 6 million barrels

of oil per day.

Past success

Oil and gas exploration drilling in Iraq began in 1902, with a well sunk on

an anticlinal structure at Chia Surkh, located in the Zagros region in central

northeast Iraq, near the Iranian border. In 1919, appraisal drilling started

in the Naft Khana area, resulting in the discovery of the first oil field in

1923. Then four years later, a turning point for exploration drilling occurred

in Iraq: In 1927, the Iraq Petroleum Company (IPC) drilled the first well, on

the Kirkuk structure (specifically on the Baba Dome, the southernmost culmination

on the Kirkuk structure). The well, Baba Gurgur No. 1, struck oil in dramatic

fashion: An uncontrolled gusher, which reached 50 feet above the derrick, drenched

the surrounding countryside and threatened nearby villages and the town of Kirkuk.

After nearly nine days, the well workers finally brought it under control. Before

capped, however, it had flowed at 95,000 barrels per day.

Despite its success at Kirkuk, IPC focused its primary exploratory efforts prior

to World War II in the region farther southeast, in the Iranian Zagros Foldbelt.

When exploration resumed after World War II, IPC discovered the Zubair Field

in 1948 and the Rumaila Field in 1953. Renewed exploration in the foldbelt led

to the discovery of oil at Bai Hassan (1953) and Jambur (1954) — leading

to the discoveries of many other oil fields in Iraq prior to the suspension

of IPC’s exploration activities in 1961.

After the passing of Law No. 80 in 1960, the Iraqi National Oil Company (INOC)

initiated its own drilling plans for developing the discovered fields. Their

extensive exploration and drilling was sufficient to cover the entire country.

By 1988, the number of exploratory wells drilled totaled 125.

Although IPC estimated in 1968 that the total recoverable reserves of oil in

Iraq was about 36 billion barrels, experts now consider those early figures

very much an underestimate. Even at that time, Iraq put the reserves at 60 billion

barrels, based on the primary producing fields of Rumaila, Kirkuk and some other

smaller fields. However, because both these figures exclude many minor producing

horizons, experts consider reserve assessments for the country on the conservative

side; there is probably much more oil in place than has been declared. Even

relatively small oil fields like Butmah and Ain Zalah easily qualify as giant

oil fields, but these are dwarfed by Iraq’s super-giants, the Kirkuk, Rumaila,

East Baghdad and Majnoon Fields.

Underlying geology

Over the past few decades, geologists have studied the sedimentary history

of Iraq, achieving a reasonably good understanding. Two features dominate the

sedimentary record of the area: the Arabian Shield to the west and the Tethyan

passive margin/Zagros collision zone to the east.

The sedimentary

history of Iraq also exhibits a variety of ages in different areas as a result

of a series of epeirogenic (tectonic) cycles, especially in the western and

central parts of Iraq. Orogenic movements are more characteristic of the northern

and northeastern parts of Iraq.

The sedimentary

history of Iraq also exhibits a variety of ages in different areas as a result

of a series of epeirogenic (tectonic) cycles, especially in the western and

central parts of Iraq. Orogenic movements are more characteristic of the northern

and northeastern parts of Iraq.

The first well was drilled in Iraq in

1927 at the Kirkuk structure. Since then, geologists have discovered 73 major

fields, nine of which are super-giants and 22 of which are giants.

Virtually all of the 440,000 square kilometers of Iraq lie within the North

Arabian Basin. This vast sedimentary basin extends from the Arabian-Nubian Platform

in the west to the alpine-folded Zagros Mountains in the east. It dates from

the Precambrian and contains more than 15 kilometers of Infra-Cambrian to Recent

sediments.

Prolific source rock, reservoir and seal rock combinations occur throughout

the geologic column. A lack of source rocks is not expected to be a problem

in Iraq because of numerous and rich hydrocarbon indications present at exploratory

drilling sites. The differences in oil accumulations between the various tectonic

areas of Iraq mainly relate to size and closure of structures, and also to reservoir

development/facies distribution, but not to the absence of source rocks or seals.

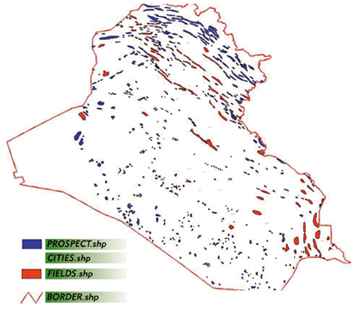

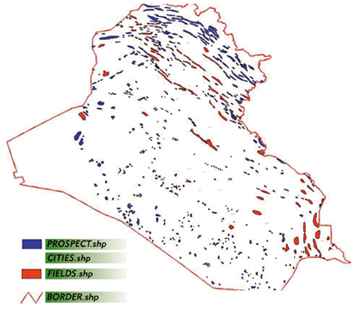

To date, petroleum geologists have delineated and mapped over 526 prospects

— drilling 131 prospects to discover 73 major fields. They have identified

some 239 as having a high degree of certainty, but those prospects remain undrilled.

Thirty fields have been partially developed and only 12 fields are actually

onstream. Undrilled structures and undeveloped fields could represent the largest

untapped hydrocarbon resource anywhere in the world.

About 30 to 40 percent of discovered Iraqi oil reserves lie within a few thousand

feet of the surface, while more than 60 percent of the discovered reserves lie

within 10,000 feet. Most of Iraq’s proven oil reserves are distributed

over 73 fields, nine of which are super-giants and 22 of which are giants. The

remainder are considered large by world standards.

Most of the developed reservoirs are of Cretaceous age. These account for approximately

76 percent of total production, while Tertiary production represents around

23.9 percent. The remaining 0.1 percent of production comes from the Jurassic,

Triassic and Ordovician.

Looking to the future

The removal of the sanctions on Iraq will present exciting exploration opportunities.

Geologists expect the exploration effort to concentrate on areas with high potential,

relying on collaboration between the Iraqi authority and international oil companies,

on a production sharing risk contract basis — in which contracted companies

would give technical and financial services for exploration and development

operations in exchange for a stipulated share of the oil produced (a reward

for the risk taken and services rendered).

One area being promoted now for this new collaborative strategy is the western

desert, an area well-advertised for its availability of exploration blocks.

The initial investment required per block is estimated at around $50 million,

to cover several thousand line kilometers of seismic exploration and the drilling

of a minimum of five exploration wells per block. Other production sharing agreements

would include additional geophysical, geological and exploration drilling activities

for the development of the giant fields carried out by international oil companies.

Oil experts and specialists on the Iraqi scene believe that a gradual buildup

of exploration work will take place immediately after the establishment of a

legitimate Iraqi authority. This will likely include the deployment of up to

10 2-D and 3-D seismic survey parties and up to 10 exploratory rigs per year,

in order to achieve the production target of up to 6 million barrels of oil

per day.

The aim of any future exploration strategy will be to maintain reserve replacement

of around 2 billion barrels per year. This could be achieved by implementing

the following strategy:

* carrying out extensive 2-D and 3-D seismic explorations on all the green

fields as well as on the untested prospects;

* drilling the nearly 400 remaining untested structural anomalies;

* expanding the deep drilling programs and utilizing proven oil reserves

in deep horizons;

* targeting the new Palaeozoic plays in the western desert, especially in

light of the recent discovery at Salah Aldin (Akkas);

* and targeting potential stratigraphic traps within the Cenozoic, Mesozoic

and Palaeozoic sections that have proven potential. |

Iraq

has the capability to reach a production plateau of 5 to 6 million barrels of

oil per day within a relatively short period of time — by expanding the

number of producing oil fields and by developing the promising central sector

fields, such as East Baghdad, Balad and Ahdeb, as well as the newly appraised

fields in the north, such as Hamrin, Saddam, West Tikrit and Khurmala. Presently,

Iraq’s production comes from only 15 developed fields out of a potential

73 discovered fields.

Iraq

has the capability to reach a production plateau of 5 to 6 million barrels of

oil per day within a relatively short period of time — by expanding the

number of producing oil fields and by developing the promising central sector

fields, such as East Baghdad, Balad and Ahdeb, as well as the newly appraised

fields in the north, such as Hamrin, Saddam, West Tikrit and Khurmala. Presently,

Iraq’s production comes from only 15 developed fields out of a potential

73 discovered fields.

Petroleum geologists have delineated and

mapped more than 526 prospects, drilling 131 prospects to discover 73 major

fields. Some 239 undrilled prospects have a high degree of certainty. Thirty

fields have been partially developed and 12 fields are actually onstream.

Iraq needs to develop the remaining 58 fields; the other 15 developed fields

may require further investment to enhance their potential. This strategy would

require the drilling of thousands of new wells over a span of five to 10 years,

as well as the installation of new surface facilities (gathering centers, tank

farms, pipelines, etc.).

The 15 developed fields present an immediate target for further enhancement

and expansion to increase present production levels by at least 1 million barrels

of oil per day. New project management schemes and reservoir simulation studies

(with the help of international oil companies supplying and installing new equipment

and providing oil field services) are necessary to increase present production

levels. An estimate of the initial capital cost required is about $4,000 per

barrel of daily production (i.e. $400 million initial costs for a field that

can produce 100,000 barrels per day), or perhaps less, if the facilities and

the infrastructure needed for storage and transportation of the crude already

exist.

The development of major new reservoirs within existing fields is an attractive

prospect for foreign investment because the infrastructure and facilities are

already in place. The most obvious targets for development are the middle Cretaceous

Mishrif reservoir and the lower Cretaceous Yamama reservoir in the southern

fields, the Jurassic Najmah reservoir in the Rumaila and West Qurna Fields,

and the Cretaceous reservoirs in the northern fields.

The 58 undeveloped fields, including giant fields such as Majnoon, Nahr Umr,

Halfaya and West Qurna, are available for immediate development under production

sharing agreement terms. Roughly $10 billion is necessary to develop 2 million

barrels of oil per day over an eight to 10 year period, with the possibility

of initial revenue being generated within two years using existing facilities.

A further 20 large- to medium-sized fields, with a production capacity of 1.5

million barrels of oil per day, can be developed relatively easily since they

are located near existing production centers at Kirkuk, Baghdad and Basra.

High prospects

Clearly, large parts of Iraq are still virgin — its large hydrocarbon

reserves are still waiting to be developed to their full potential, while most

other Middle East countries are fully exploiting their reserves.

The main challenges facing the new Iraqi authority are to establish law and

order as well as security. Once these issues are resolved, Iraq will perhaps

be the most exciting place on Earth with regard to oil development and exploration.

Despite the reported loss and destruction of rock core and seismic data in the

aftermath of the recent conflict, several private companies have such data archived.

And much of what was lost was old data in need of replacement — additional

incentive to deploy the latest 3-D seismic technology to add to and rebuild

the national exploration archives.

International oil companies are looking forward with great anticipation to the

opening of Iraq, as they have been waiting for the past 40 years. Hopefully,

Iraq will soon be able to offer them acreage, thereby allowing proper development

of its huge potential. Open and fair competition will enable oil companies to

apply the latest technologies in the search for, and development of, the country’s

hydrocarbon resources — thus helping Iraq realize its full hydrocarbon

potential.

|

War Numbers

| Estimated

Damage Assessment from Stratfor Services

War-related as of mid-July...........................................$250-350

million

Looting from mid-March 2003 through mid-July

2003.....$750 million*

*Excludes costs of recent and frequently sophisticated

sabotage attacks and looting

|

It has been a tumultuous year in Iraq, and a tumultuous year in the oil

markets. Prior to the commencement of the war in Iraq in March 2003, the

Department of Defense designated the U.S. Army Corps of Engineers as Executive

Agent of a project to repair any damage to and, continue operations of,

the Iraqi oil infrastructure. The Army Corps, in conjunction with civilian

commercial contractors, has been working since then to stabilize the Iraqi

oil infrastructure and assess damages. In August, the Corps closed the application

period for companies bidding on contracts to continue to repair and maintain

oil operations in Iraq this fall into next year. Opportunities for contracts

should open in mid- to late-October. The Corps finished its initial assessment

of war-related damage to the Iraqi oil complex in July.

Experts predict stabilizing and

slightly declining oil prices over the next year, as Iraqi production slowly

picks up the pace and the Organization of Petroleum Exporting Countries

(OPEC) adjusts production in other member states. As Iraq boasts the world’s

cheapest lifting and transport costs, experts agree that it is essential

for the country to maximize production as soon as possible.

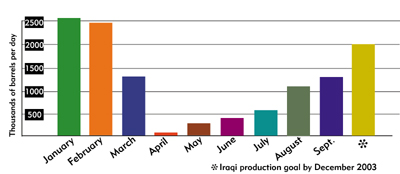

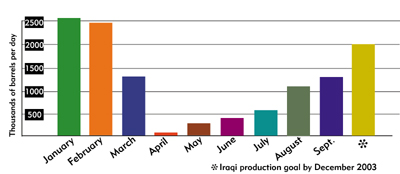

2003 Iraq Oil Production Information from the Energy Information Administration

Iraq

hopes to expand production to 2.0 million barrels of oil per day (bpd) by

December 2003, 2.8 million bpd by April 2004 and 6.0 million bpd by 2010.

Expanding production has already been slower than anticipated, as the rebuilding

faces frequent sabotage and looting, outdated oil technology, theft of crude

oil, and ongoing security issues with the main pipeline that crisscrosses

the nation. Iraq

hopes to expand production to 2.0 million barrels of oil per day (bpd) by

December 2003, 2.8 million bpd by April 2004 and 6.0 million bpd by 2010.

Expanding production has already been slower than anticipated, as the rebuilding

faces frequent sabotage and looting, outdated oil technology, theft of crude

oil, and ongoing security issues with the main pipeline that crisscrosses

the nation.

According to a U.S. State Department press release, the Department of Defense

estimates the potential oil income to the Iraqi people at $20 billion to

$30 billion per year. A percentage of that will be used to rebuild Iraq,

the release says.

Megan Sever

Back to top |

Al-Gailani is managing director

of GeoDesign Limited, a consultancy office based in London that specializes in

Middle East databases. Previously, he has worked as an independent consultant

on several projects in the Middle East and in South America, as well as for the

Iraqi National Oil Company in Baghdad. He graduated from Baghdad University in

1972 with a bachelor’s degree in geology and worked briefly for the Iraqi

National Oil Company in Baghdad. He later received his master’s degree from

the University of Aberdeen and his Ph.D. from Imperial College in London.

Back to top

The latest

estimates put Iraq’s potential reserves at around 150 to 200 billion barrels

of oil and 106 trillion cubic feet of gas. These figures put Iraq in the forefront

of oil-producing countries: Iraqi oil reserves are considered to be the second

largest in the world, after Saudi Arabia’s.

The latest

estimates put Iraq’s potential reserves at around 150 to 200 billion barrels

of oil and 106 trillion cubic feet of gas. These figures put Iraq in the forefront

of oil-producing countries: Iraqi oil reserves are considered to be the second

largest in the world, after Saudi Arabia’s.

The sedimentary

history of Iraq also exhibits a variety of ages in different areas as a result

of a series of epeirogenic (tectonic) cycles, especially in the western and

central parts of Iraq. Orogenic movements are more characteristic of the northern

and northeastern parts of Iraq.

The sedimentary

history of Iraq also exhibits a variety of ages in different areas as a result

of a series of epeirogenic (tectonic) cycles, especially in the western and

central parts of Iraq. Orogenic movements are more characteristic of the northern

and northeastern parts of Iraq. Iraq

has the capability to reach a production plateau of 5 to 6 million barrels of

oil per day within a relatively short period of time — by expanding the

number of producing oil fields and by developing the promising central sector

fields, such as East Baghdad, Balad and Ahdeb, as well as the newly appraised

fields in the north, such as Hamrin, Saddam, West Tikrit and Khurmala. Presently,

Iraq’s production comes from only 15 developed fields out of a potential

73 discovered fields.

Iraq

has the capability to reach a production plateau of 5 to 6 million barrels of

oil per day within a relatively short period of time — by expanding the

number of producing oil fields and by developing the promising central sector

fields, such as East Baghdad, Balad and Ahdeb, as well as the newly appraised

fields in the north, such as Hamrin, Saddam, West Tikrit and Khurmala. Presently,

Iraq’s production comes from only 15 developed fields out of a potential

73 discovered fields. Iraq

hopes to expand production to 2.0 million barrels of oil per day (bpd) by

December 2003, 2.8 million bpd by April 2004 and 6.0 million bpd by 2010.

Expanding production has already been slower than anticipated, as the rebuilding

faces frequent sabotage and looting, outdated oil technology, theft of crude

oil, and ongoing security issues with the main pipeline that crisscrosses

the nation.

Iraq

hopes to expand production to 2.0 million barrels of oil per day (bpd) by

December 2003, 2.8 million bpd by April 2004 and 6.0 million bpd by 2010.

Expanding production has already been slower than anticipated, as the rebuilding

faces frequent sabotage and looting, outdated oil technology, theft of crude

oil, and ongoing security issues with the main pipeline that crisscrosses

the nation.